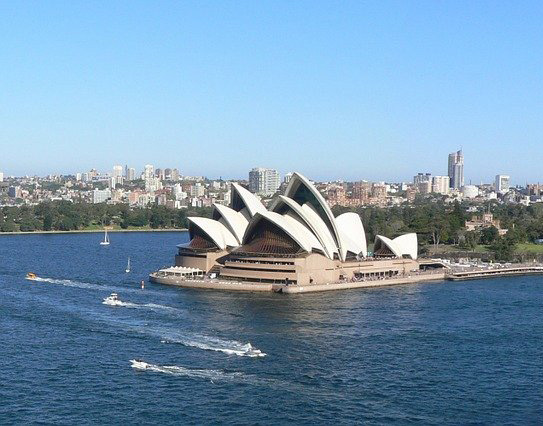

Sydney

Affordable Car Plans in Sydney

" Get a Second Chance with CarCoop "

Rent-To-Own Cars Sydney

Rent to Own car is an excellent alternative for credit-challenged individuals or those who have a problem getting approved for a car loan due to their credit history to own a vehicle. Rent-to-own models do not require credit checks and are not considered a type of loan, so it’s a lot easier to get approved. Unlike traditional car rentals, each repayment helps you move closer to owning the vehicle at the end of the contract period.

A wide range of rent-to-own cars is available for pick-up at CarCoop Sydney. So if you live within the greater Sydney suburbs, contact our team at 1300 614 299.

What types of rent-to-own vehicles are available?

CarCoop has a wide range of rent-to-own vehicles that customers can choose from, which include compact cars, family sedans, hatchbacks, and SUVs. All our late-model vehicles have their Roadworthy Certificate (RWC) and have been cleaned and fully serviced. Smaller vehicles may be available for as little as $199 per week, while bigger or newer models can go up to $299. This includes annual scheduled servicing, comprehensive insurance, roadside assistance and registration for the entire length of the agreement.

Can I still apply even if my credit history is not squeaky clean?

A customer is considered a bad credit customer if they have an impaired credit history due to defaults or having more credit applications than the average. Credit history is a report that shows the customer’s credit activity for the last seven years. And even if you have been working hard on your banking conduct to have good financial standing at that time, the credit history report holds you back from getting approved for a car loan.

With a bad credit history, a customer can expect car loan interest rates as high as 24% per annum and as high as 40% with the fees and other charges paid on top. In addition, the customer may also face limitations on what type of vehicles they can purchase, which is up to the lender or bank. And the worst case, the customer may be refused a loan outright which will also reflect on your credit history.

Unlike a car loan, rent-to-own options don’t require credit checks. Instead, rent-to-own car providers assess the customer’s current financial information to see if they can afford the payment for the entire length of the contract.

What’s even better with a rent-to-own model, if you maintain a good payment standing, you’ll be allowed to upgrade to a newer model vehicle mid-way, unlike with car loans where you cannot change cars mid-way if you need to.

How do I get a rent-to-own vehicle in Sydney?

If you live in Sydney or nearby suburbs such as Illawarra, Newcastle, Wollongong or Penrith, you can enquire and apply online with CarCoop. Whatever your credit history, you’re guaranteed an assessment that’s based solely on your current financial capabilities. We don’t do credit checks, but we will assess your current financial information to see if you can afford the weekly repayment. You will also need to put down a small deposit based on the type of car that you will be approved for.

If you’re 21 years of age or above, hold a P2 driver’s licence or above, and are employed with a weekly income of at least $800, you can apply for CarCoop’s Rent-to-own car program. It’s a true and proven pathway to car ownership without having to apply for a car loan.